5 May 2022 Afternoon Session Analysis

Pound lingers ahead of BoE Meeting.

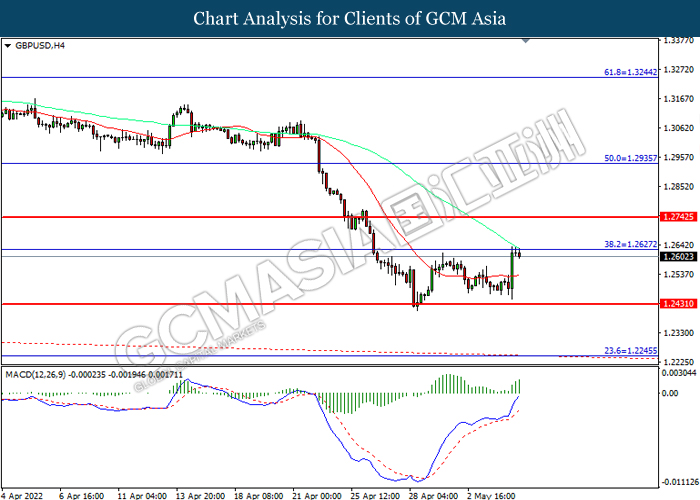

Pound, one of the major currencies hovered near the one-week high level as market participants are still eyeing on the upcoming BoE (Bank of England) meeting. As of now, market consensus is expecting the BoE members to vote for 25 basis point hike, which would lift the Official Bank Rate to 1.00%. Prior to that, Governor of BoE – Andrew Bailey hinted that they will continue to maintain its current rate hike pace to support the economy to tide through the post pandemic inflation surge, which has been exacerbated by the Russia’s invasion of Ukraine. According to the latest data, UK annual inflation hit 7% in March as ongoing supply chain issue persists. Just like any other major central banks, BoE is facing the risk in curbing the overheated economy. At this juncture, the market participants and economist are waiting for the BoE meeting to gauge the further direction of the Pound. As of writing, the pair of GBP/USD dropped by 0.20% to 1.2600.

In commodities market, the crude oil price up by 0.44% to $108.45 per barrel despite oil inventories build unexpectedly. According to the EIA, U.S. Crude Oil Inventories up 1.302M, greater than the market expectation of -0.829M. On the other hand, gold price appreciated by 1.07% to $1901.35 per troy ounce amid dovish statement from Federal Reserve Chairman, Jerome Powell.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE Inflation Report

19:00 GBP BoE MPC Meeting Minutes

21:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | Composite PMI (Apr) | 57.6 | 57.6 | – |

| 16:30 | Services PMI (Apr) | 58.3 | 58.3 | – |

| 19:00 | BoE Interest Rate Decision (May) | 0.75% | 1.00% | – |

| 20:30 | Initial Jobless Claims | 180K | 182K | – |

Technical Analysis

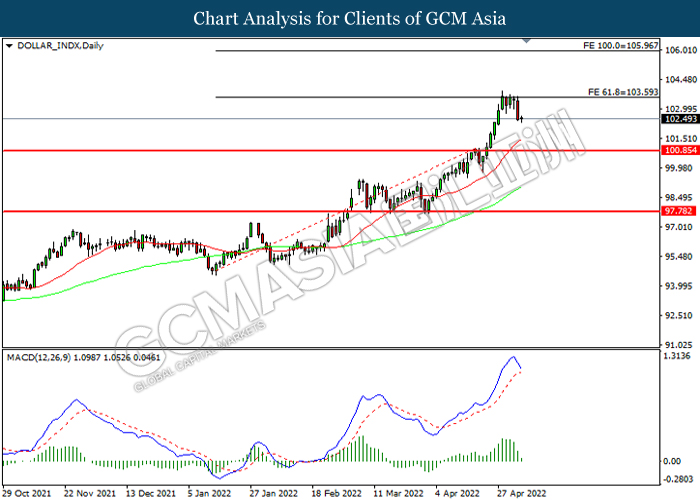

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward support level.

Resistance level: 103.60, 105.95

Support level: 100.85, 97.80

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2625, 1.2745

Support level: 1.2430, 1.2245

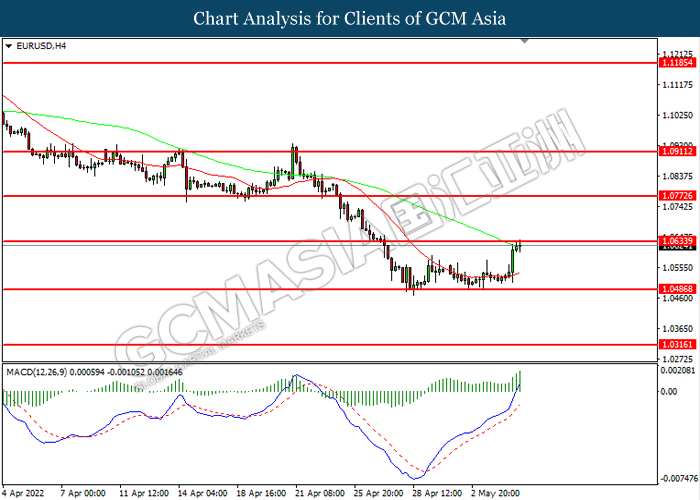

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it breakout the resistance level.

Resistance level: 1.0635, 1.0775

Support level: 1.0485, 1.0315

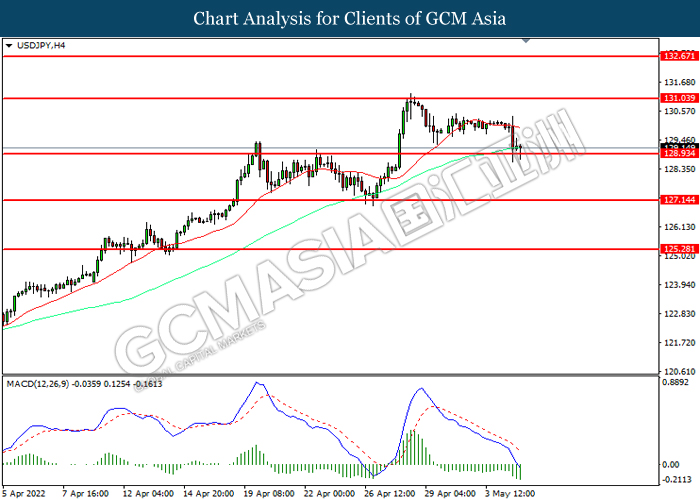

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 131.05, 132.65

Support level: 128.95, 127.15

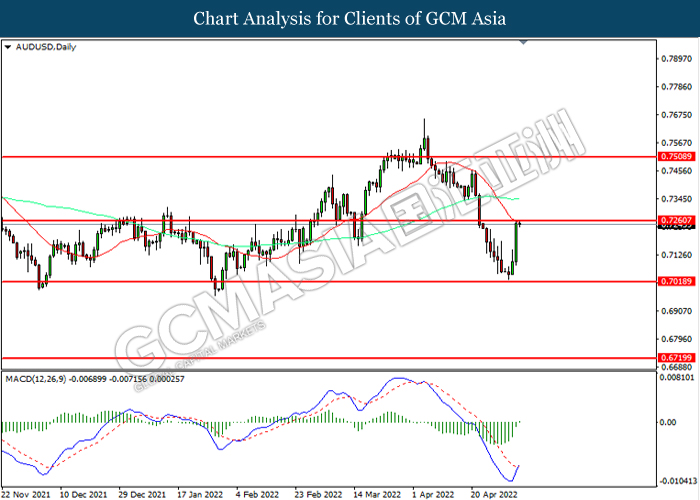

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.7260, 0.7510

Support level: 0.7020, 0.6720

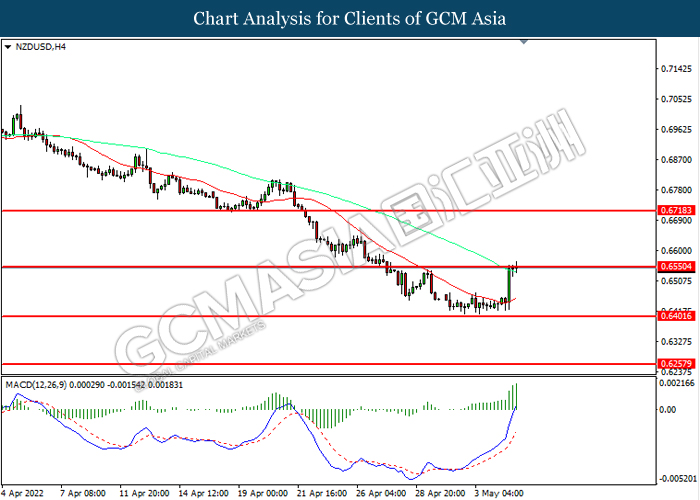

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6550, 0.6720

Support level: 0.6400, 0.6260

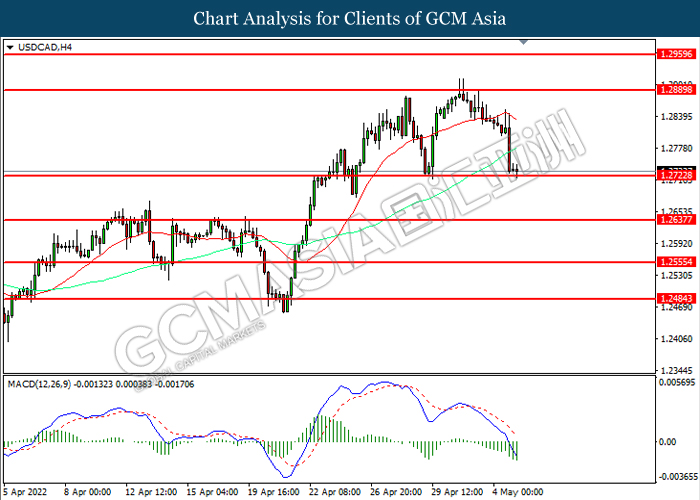

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2890, 1.2960

Support level: 1.2750, 1.2635

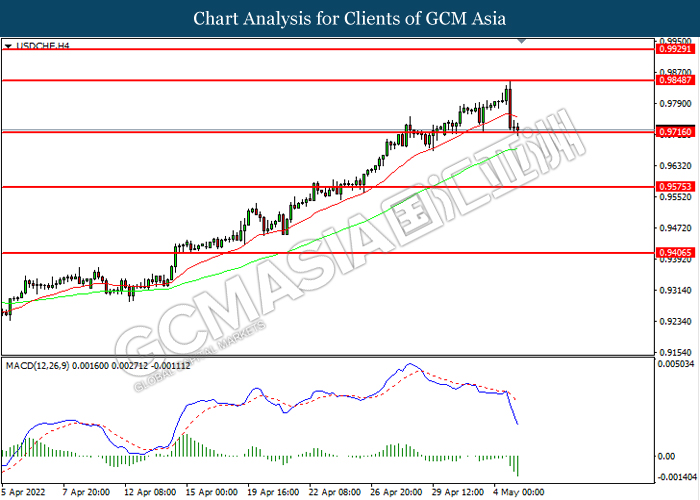

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9850, 0.9930

Support level: 0.9715, 0.9575

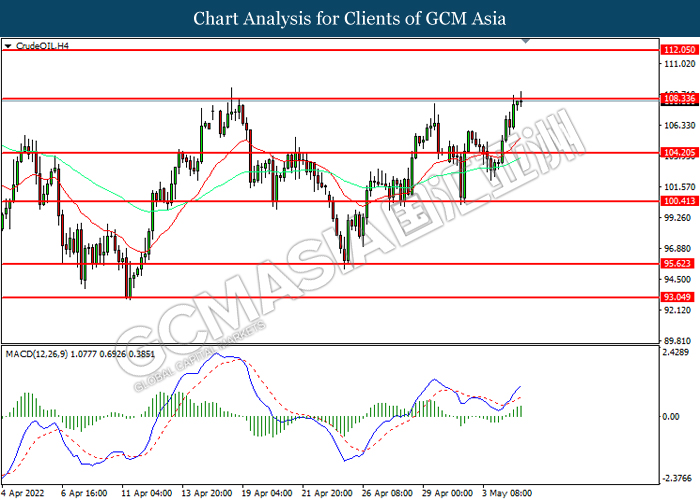

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 108.35, 112.05

Support level: 104.20, 100.40

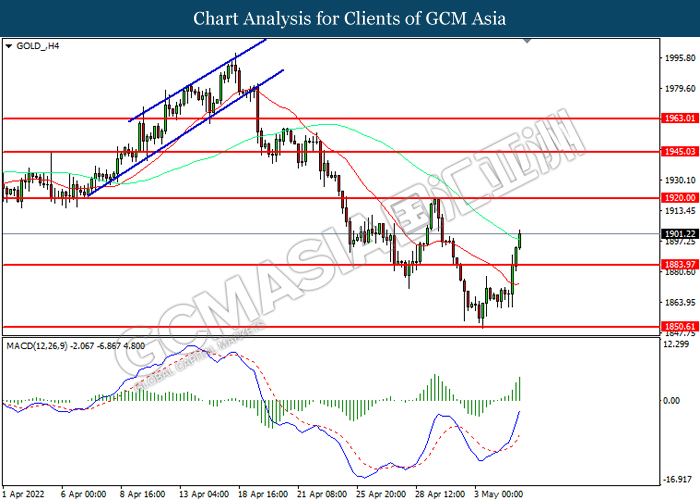

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 1920.00, 1945.05

Support level: 1883.95, 1850.60