10 May 2022 Morning Session Analysis

US Dollar rose following market inflation concerns.

The Dollar Index which traded against a basket of six major currencies edged up on Tuesday over the concern for inflation risk from the market. Russia invasion of Ukraine had led to the disruption of global supply chain, causing the commodities price such as crude oil to soar. The war-driven inflation had brought negatives prospects toward global economic growth, which dialed up the market optimism toward the risk-averse assets such as US Dollar. Besides, Federal Reserve Chairman Jerome Powell had claimed that the US central bank will act aggressively to stamp out inflation. He reiterated that the additional 50 basis point rate hike should be on the table for the next couple of meetings, which sparkling the appeal for the US Dollar. Nonetheless, the gains experiences by Dollar Index was limited following the ease of US 10-Year Treasury yields. According to Reuters, yields on most US Treasury notes pared early gains to trade lower on Monday as bargain-hunters stepped in after the benchmark 10-year yield hit fresh three and the half year highs of 3.203% as inflation fears continued to roil markets. As of writing, the Dollar Index appreciated by 0.08% to 103.77.

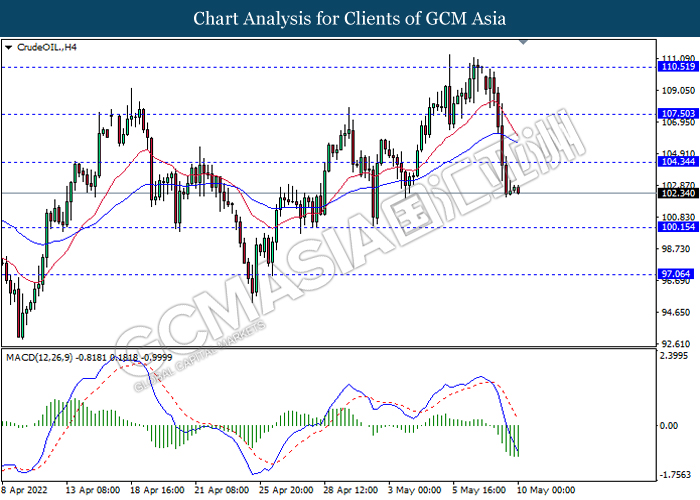

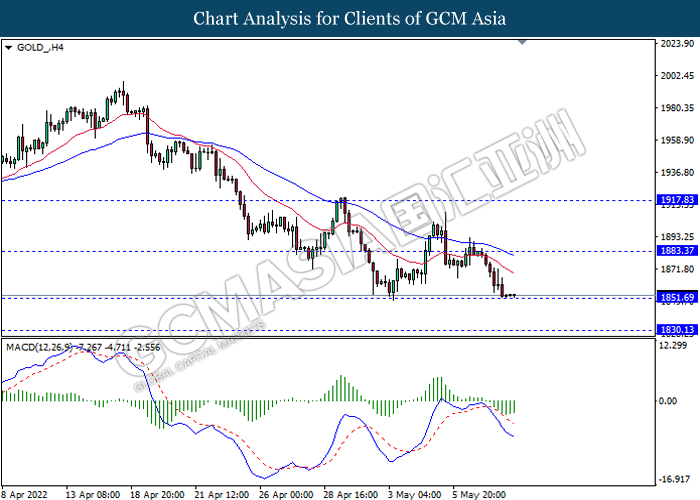

In commodities market, crude oil price depreciated by 0.38% to $102.70 per barrel as of writing amid the backdrop of rising Covid-19 cases in China, which diminishing the demand for crude oil. On the other hand, gold price depreciated by 0.28% to $1853.32 per troy ounce as of writing over the rallies of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | German ZEW Economic Sentiment (May) | -41.0 | -42.5 | – |

Technical Analysis

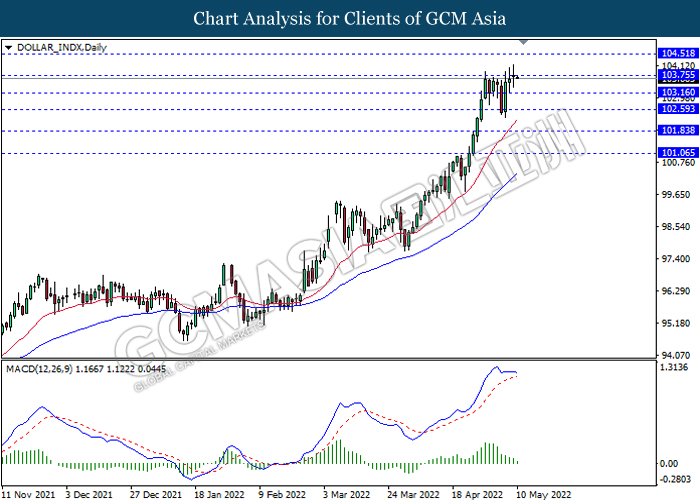

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 103.75, 104.50

Support level: 103.15, 102.60

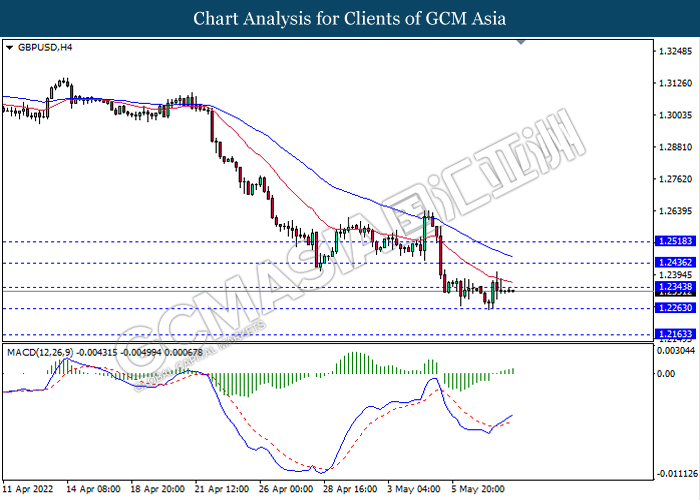

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2345, 1.2435

Support level: 1.2265, 1.2165

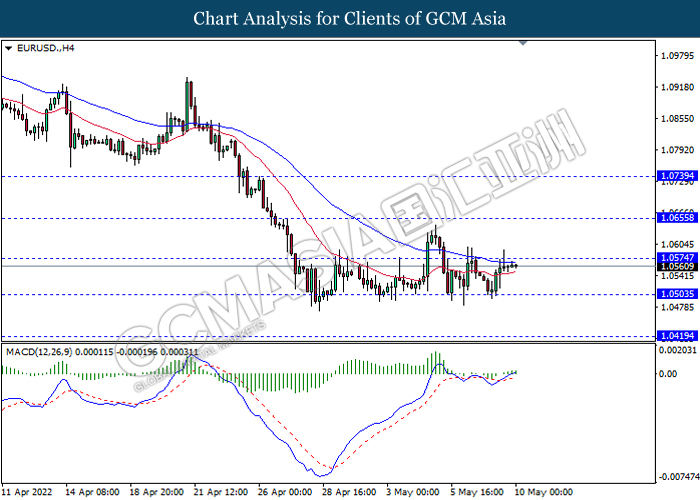

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0575, 1.0655

Support level: 1.0505, 1.0420

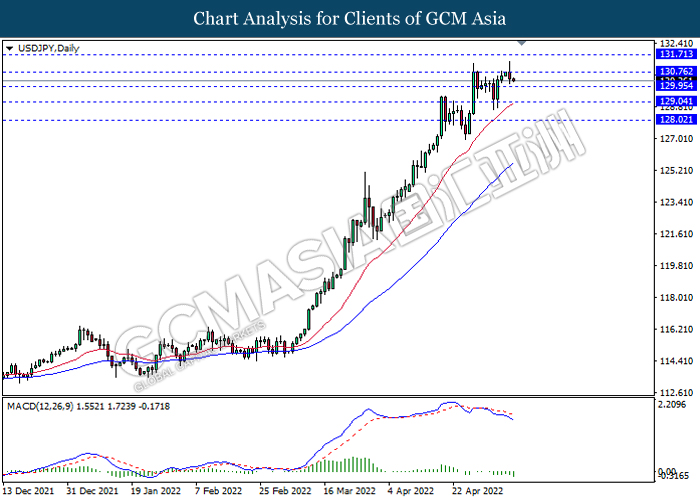

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to be extend its losses.

Resistance level: 130.75, 131.70

Support level: 129.95, 129.05

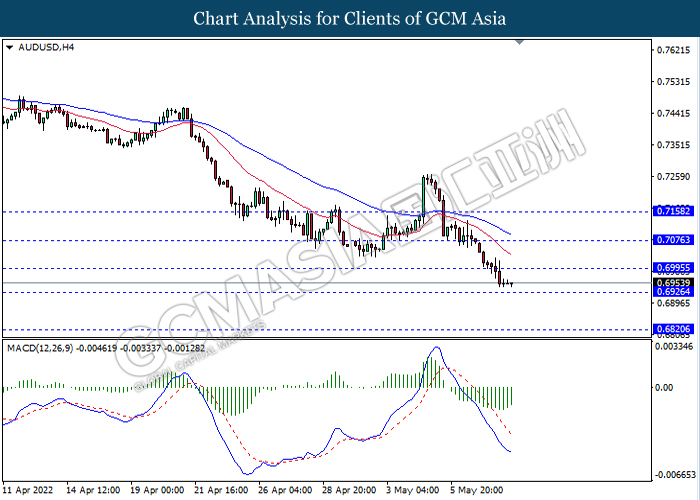

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6995, 0.7075

Support level: 0.6925, 0.6820

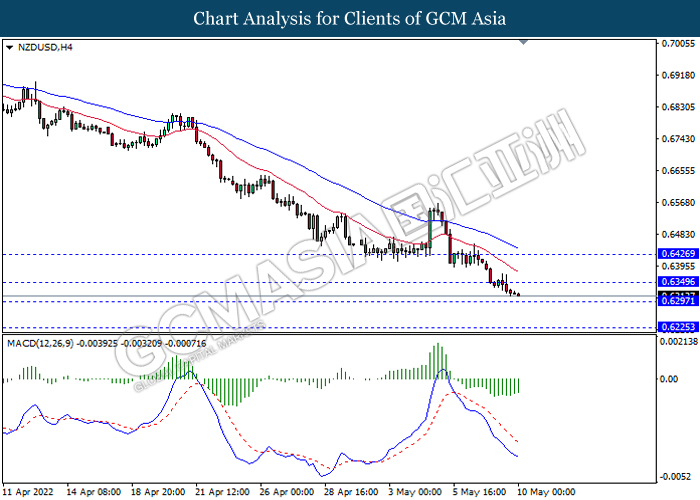

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6350, 0.6425

Support level: 0.6295, 0.6225

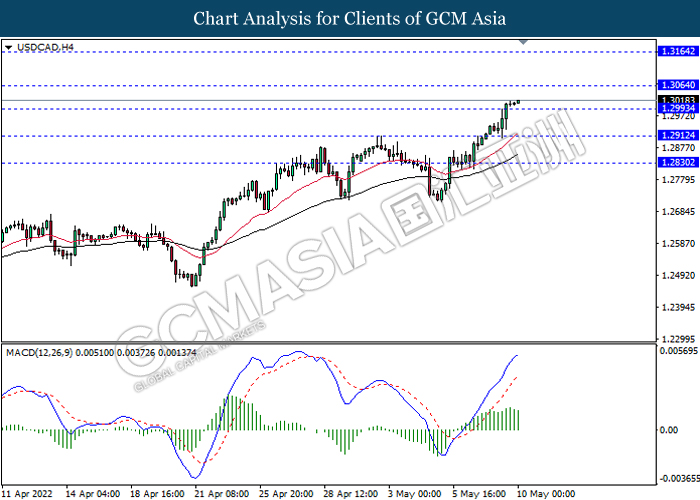

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3065, 1.3165

Support level: 1.2995, 1.2910

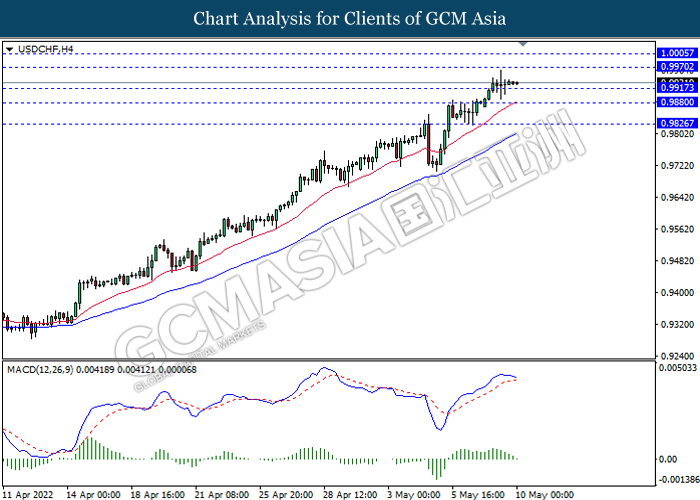

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9970, 1.0005

Support level: 0.9915, 0.9880

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 104.35, 107.50

Support level: 100.15, 97.05

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1883.35, 1917.85

Support level: 1851.70, 1830.15