19 May 2022 Morning Session Analysis

Safe-haven Dollar rallied over the market inflation concerns.

The Dollar Index which traded against a basket of six major currencies rose on Thursday over the backdrop rising inflation concern beaten down the risk-sentiment assets. According to Reuters, The mood was underscored by a 9% surge in British consumer prices and a faster-than-expected acceleration in inflation in Canada. British inflation surged to its highest annual rate since 1982 as energy bills soared, while Canadian inflation rose to 6.8% last month, largely driven by rising food and shelter prices, Statistics Canada data showed. The soaring inflation risk had dialed up the market optimism toward safe-haven products such as US Dollar, prompting investors to purchase US Dollar in order to protect their capitals. Besides, the Dollar Index extend its gains following the hawkish tone from Federal Reserve. According to CNBC, Federal Reserve Chairman Jerome Powell reiterated on Tuesday that he will back interest rate increases until prices start falling back toward a healthy level, including taking rates above neutral, spurring further bullish momentum on the US Dollar. As of writing, the Dollar Index appreciated by 0.53% to 103.95.

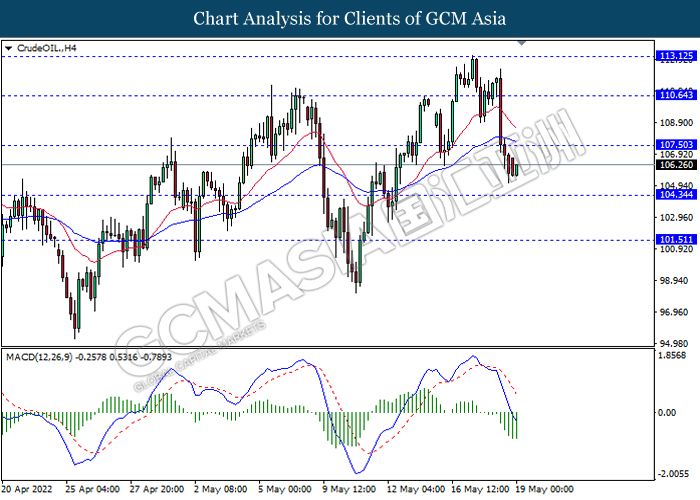

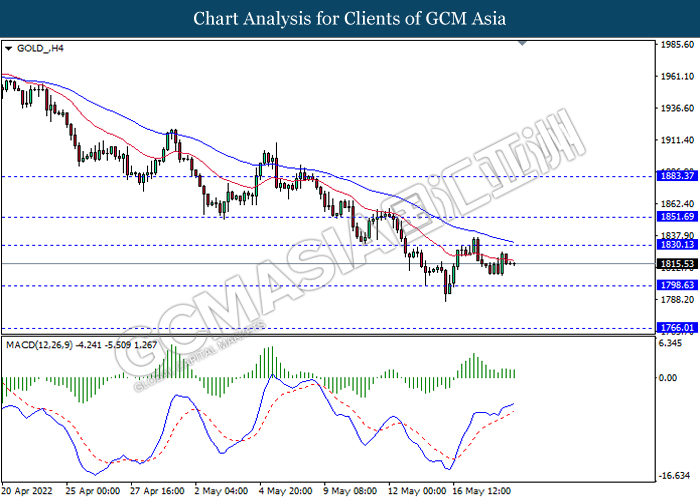

In commodities market, crude oil price slumped by 1.20% to $105.75 per barrel as of writing amid Japan would sell around 750,000 kiloliters, or 4.72 million barrels of crude oil from its national oil reserves. On the other hand, gold price edged down by 0.13% to $1813.90 per troy ounces as of writing over the surging of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | Initial Jobless Claims | 203K | 200K | – |

| 20:30 | Philadelphia Fed Manufacturing Index (May) | 17.6 | 16.7 | – |

| 22:00 | Existing Home Sales (Apr) | 5.77M | 5.62M | – |

Technical Analysis

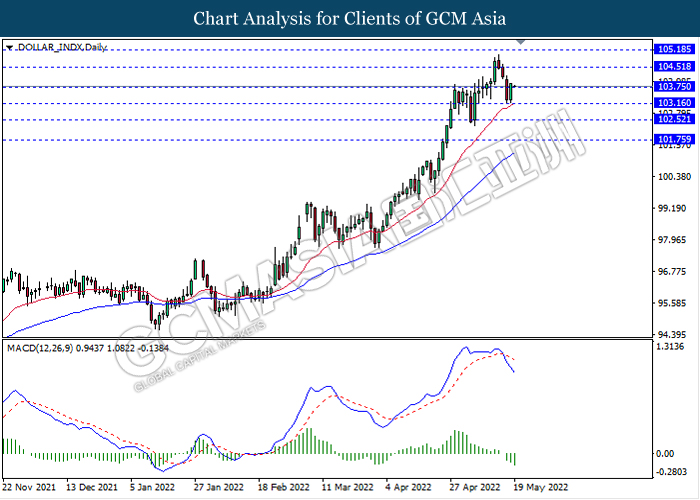

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the index to be traded lower as technical correction.

Resistance level: 104.50, 105.20

Support level: 103.75, 103.15

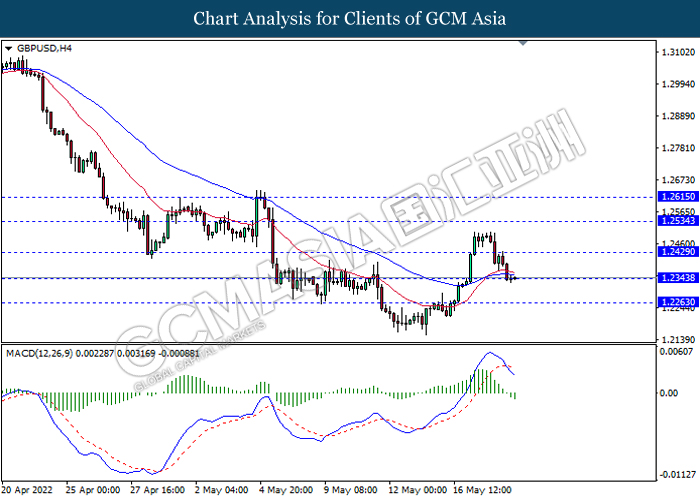

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2430, 1.2535

Support level: 1.2345, 1.2265

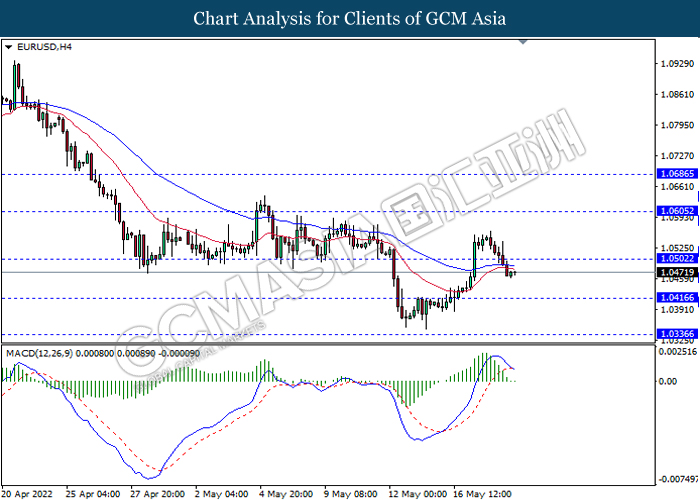

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0500, 1.0605

Support level: 1.0415, 1.0335

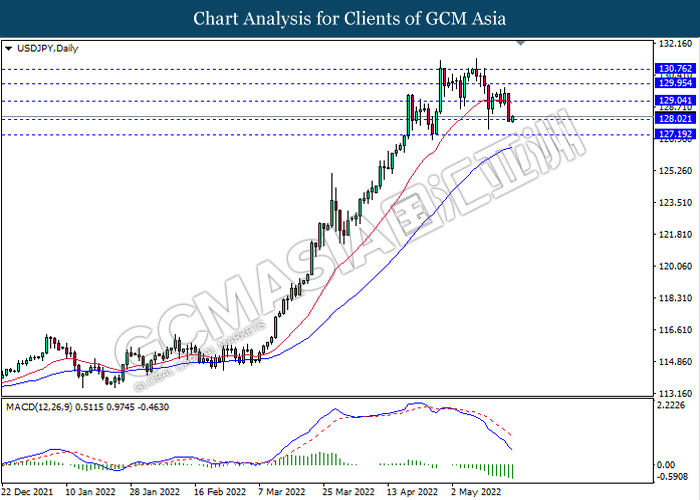

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to be extend its losses if successfully breakout the support level.

Resistance level: 129.05, 129.95

Support level: 128.00, 127.20

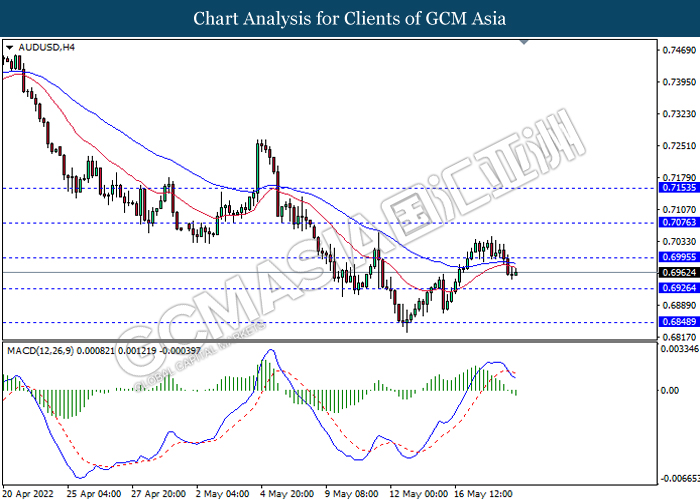

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6995, 0.7075

Support level: 0.6925, 0.6850

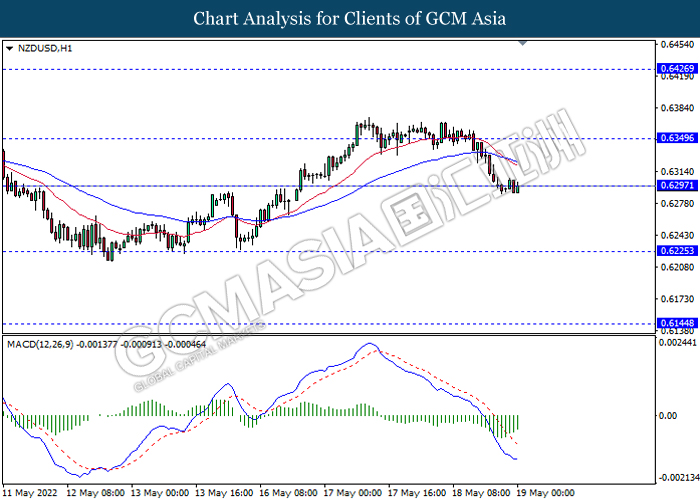

NZDUSD, H1: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6295, 0.6350

Support level: 0.6225, 0.6145

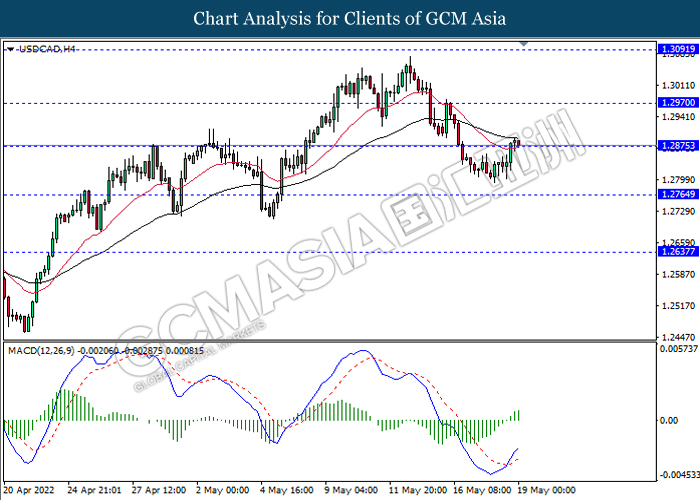

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2970, 1.3090

Support level: 1.2875, 1.2765

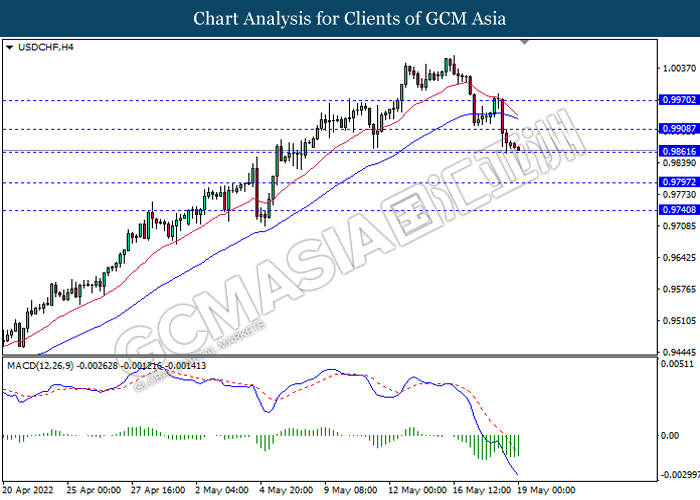

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9910, 0.9970

Support level: 0.9860, 0.9795

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 107.50, 110.65

Support level: 104.35, 101.50

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1830.15, 1851.70

Support level: 1798.65, 1766.00