04 January 2019 Afternoon Session Analysis

Dollar recovers ahead of NFP.

Dollar index rebound from its lows against its basket of six major currency pairs as US and China renewed hopes on trade talks. Market sentiment has slowly shifted towards positive side following reports on China’s commerce ministry have confirmed that a trade talk with the U.S will be held at the vice-ministerial level in Beijing next week which could ease ongoing trade tensions. However, market remains cautious following fears of economic growth slowdown and will focus on Friday’s Nonfarm Payroll data release to determine further direction. Dollar index rose 0.08% to 96.91 as of writing. Meanwhile, AUDUSD soars 0.25% to 0.7020 at the time of writing following upbeat China’s Caixin Services PMI. According to Caixin, the services data improved to 53.9, higher than expected reading of 52.9 which illustrate a steady growth in China’s service industry.

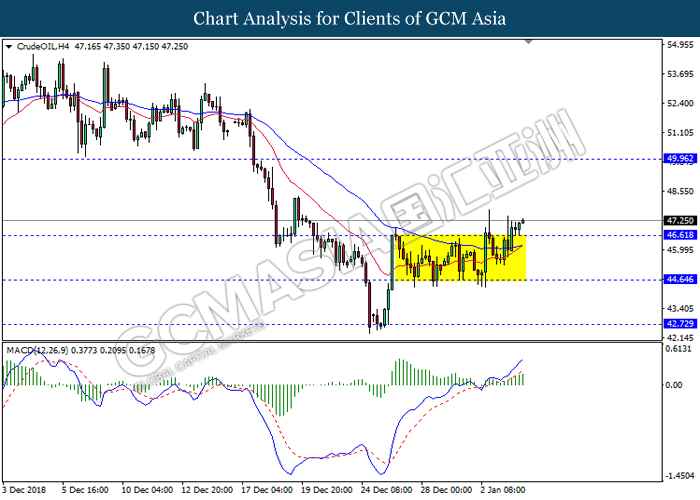

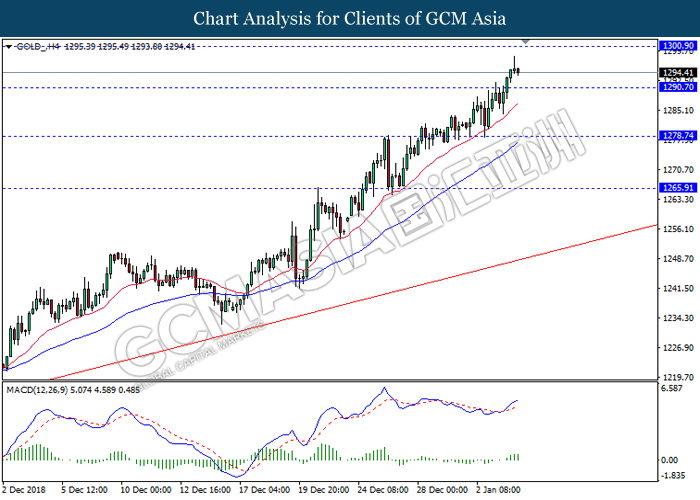

In the commodities market, crude oil price climbed 0.86% to $47.19 per barrel as of writing as market slowly lifted up by evidence of OPEC’s production limit has coming into effect with OPEC oil supply have declined 460,000 bpd to 32.68 million BPD, Besides that, American Petroleum Institute also reported weekly crude oil stock has fell to -4.5m from previous reading of 6.92M which illustrate a decreasing supply that could continue bolster the crude oil market. On the other hand, gold price rose 0.02% to 1294.15 as of writing as global uncertainty and economic growth slowdown fear continue to support the safe haven asset.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:15 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change | -16K | -12K | – |

| 17:30 | GBP – Services PMI (Dec) | 50.4 | 50.7 | – |

| 21:30 | USD – Nonfarm Payrolls (Dec) | 155K | 178K | – |

| 21:30 | USD – Unemployment Rate (Dec) | 3.7% | 3.7% | – |

| 21:30 | CAD – Employment Change (Dec) | 94.1K | 6.8K | – |

Technical Analysis

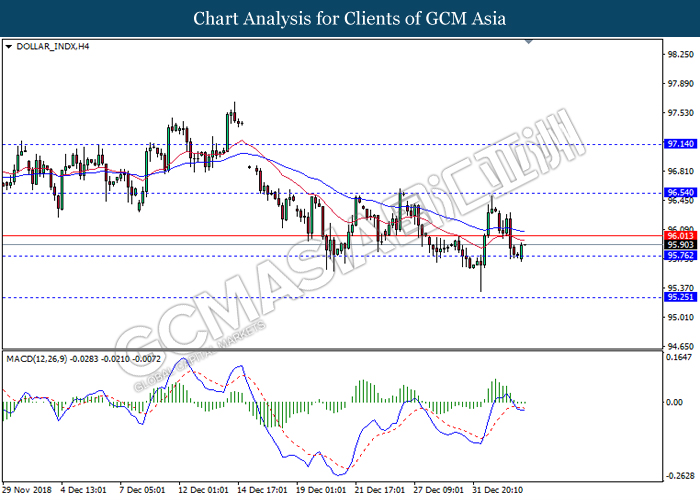

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level 95.75. MACD which display diminishing bearish momentum suggest dollar to extend its rebound towards the resistance level 96.55.

Resistance level: 96.55, 97.15

Support level: 95.75, 95.25

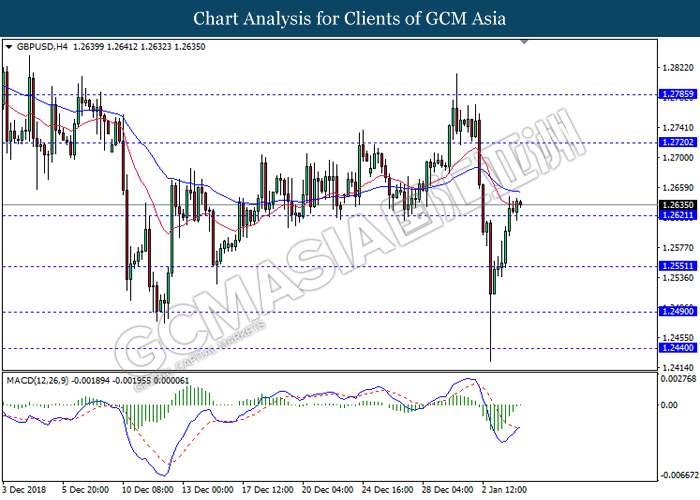

GBPUSD, H4: GBPUSD was traded higher following prior breakout above previous resistance level at 1.2620. MACD which illustrate starting bullish momentum with the formation of golden cross suggest the pair to extend its gains towards the resistance level 1.2720.

Resistance level: 1.2720, 1.2785

Support level: 1.2620, 1.2550

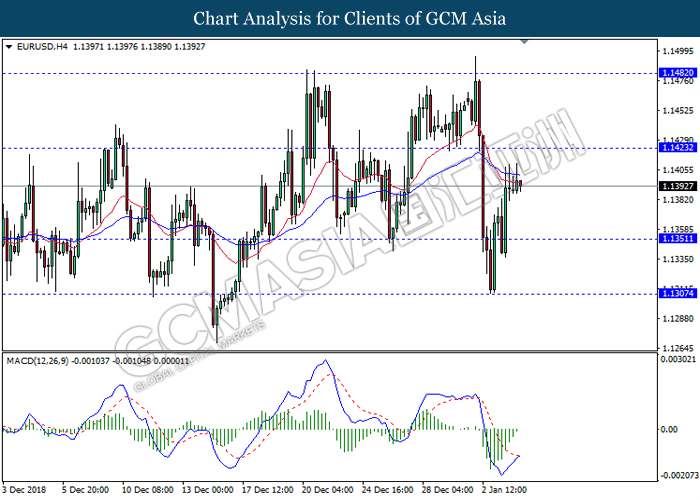

EURUSD, H4: EURUSD was traded higher following prior breakout above the resistance level 1.1350. MACD which display bullish momentum signal with the formation of golden cross suggest the pair to extend its gains towards the resistance level 1.1425.

Resistance level: 1.1425, 1.1480

Support level: 1.1350, 1.1305

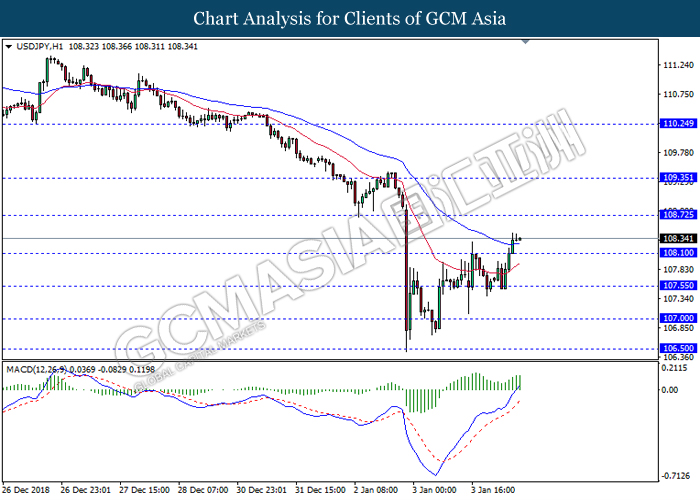

USDJPY, H1: USDJPY was traded higher following prior breakout above previous resistance level 108.10. MACD which illustrate persistent bullish momentum suggest the pair to extend its gains towards the resistance level 108.70.

Resistance level: 108.70, 10.35

Support level: 108.10, 107.55

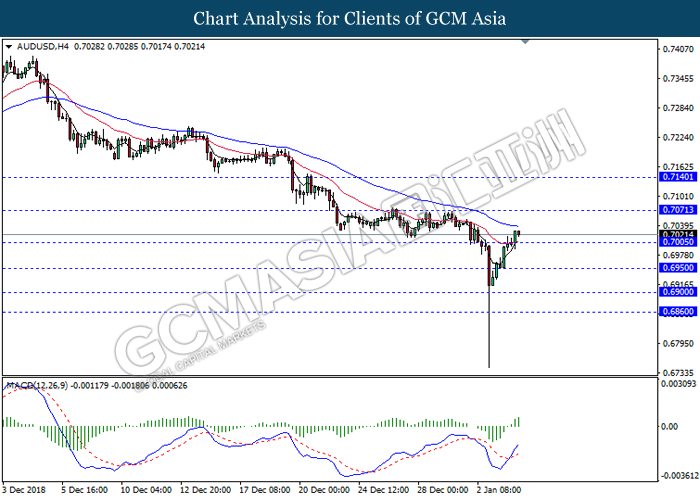

AUDUSD, H4: AUDUSD was traded higher following prior breakout above previous resistance level at 0.7005. MACD which illustrate bullish momentum and the formation of golden cross suggest the pair to extend its gains towards the resistance level 0.7070.

Resistance level: 0.7070, 0.7140

Support level: 0.7005, 0.6950

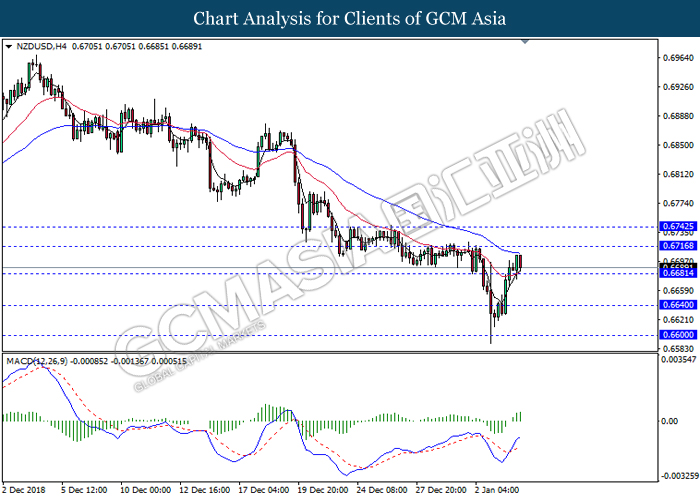

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level 0.6680. MACD which display bullish momentum suggest the pair to extend its gains towards the resistance level 0.6715.

Resistance level: 0.6715, 0.6740

Support level: 0.6680, 0.6640

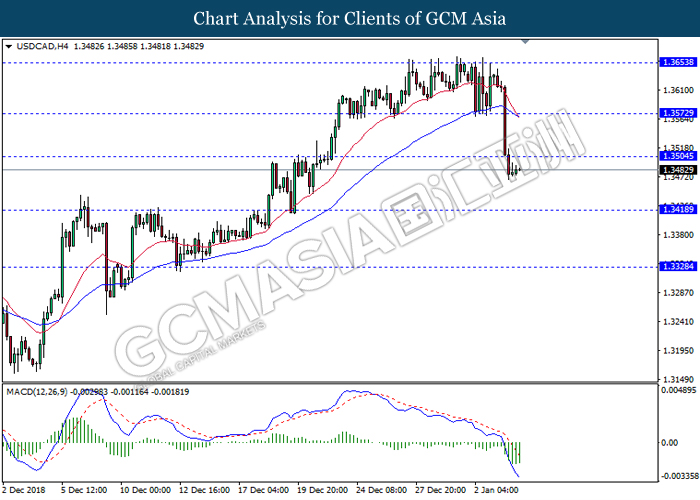

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level 1.3505. MACD which illustrate diminishing bearish momentum suggest the pair to undergo short term technical correction towards the resistance level 1.3505.

Resistance level: 1.3505, 1.3570

Support level: 1.3420, 1.3330

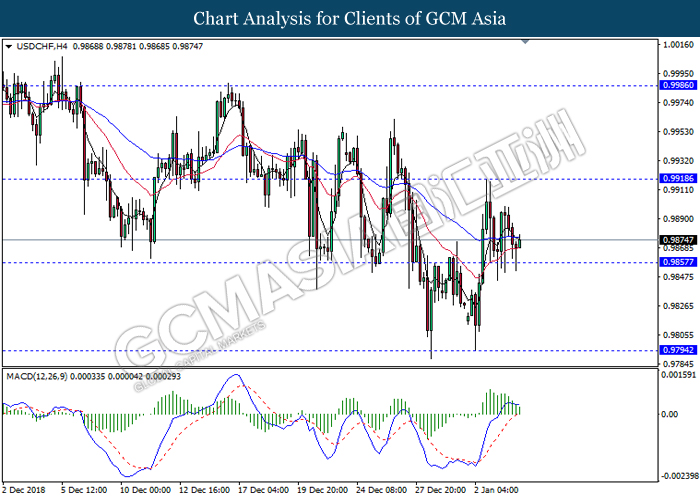

USDCHF, H4: USDCHF was traded lower following recent retracement from the resistance level 0.9920. MACD which illustrate bearish momentum suggest the pair to extend its losses towards support level 0.9855.

Resistance level: 0.9920, 0.9985

Support level: 0.9855, 0.9795

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level 46.60. MACD which display bullish momentum suggest the commodity to extend its gains towards the resistance level 49.95.

Resistance level: 49.95, 53.00

Support level: 46.60, 44.65

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level 1290.70. MACD which display bullish momentum suggest gold to extend its gains towards the resistance level 1300.90

Resistance level: 1300.90, 1319.35

Support level: 1290.70, 1278.75