8 January 2019 Afternoon Session Analysis

Dollar mends while focus on next data.

US dollar recovered some losses prior to European trading sessions while market participants continues to ponder upon the future economic releases from the economic giant. As of writing, the dollar index was up 0.20%, last seen around 95.39. Regretfully, any substantial gains on the greenback remains limited as market participants remains somber towards US economic outlook and possible policy guidance. Overnight, US dollar received substantial selling pressure after ISM reported a lower than expected reading in non-manufacturing PMI with only 57.6 versus forecast of 59.6 for last month. The data has added up to a series of downbeat releases which indicates significant slowdown in economic activity and progression. In addition, traders are widely speculating a possible pause in monetary policy tightening after Jerome Powell indicates that future policy depends on current economic conditions. On the other hand, pair of USD/JPY recovered its losses by 0.16% to 108.88. Safe haven currencies across the board received some setbacks as demand for riskier assets increases.

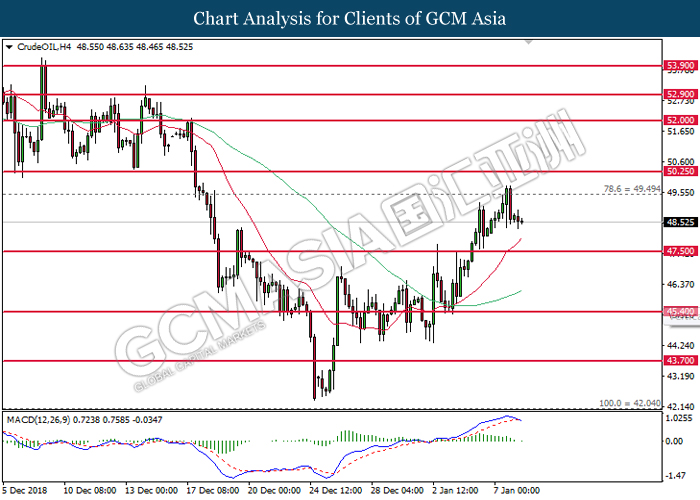

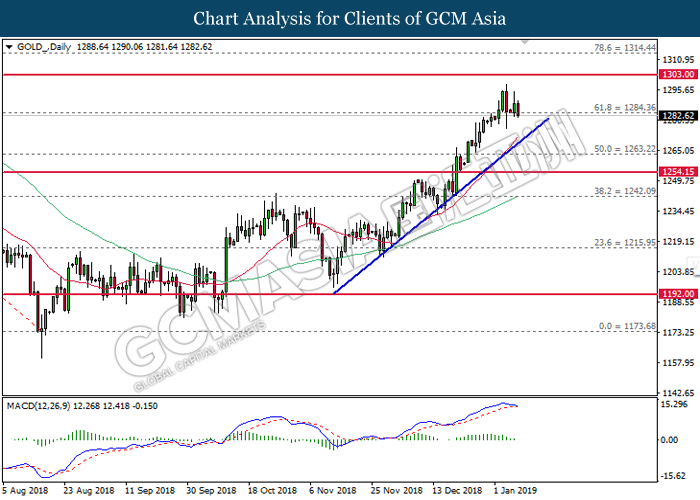

In the commodities section, crude oil price plunged 0.25% or 12 cents to $48.52 per barrel. The commodity received some pressure as a recovery in US dollar makes the appeal of dollar-denominated assets to appear more expensive for bearers of non-dollar currencies. Otherwise, gold price tumbled 0.43% to $1,283.66 a troy ounce following a rebound in US dollar and risk appetite.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German Industrial Production (MoM) (Nov) | -0.5% | 0.3% | – |

| 23:00 | USD – JOLTS Job Openings (Nov) | 7.079M | 7.170M | – |

Technical Analysis

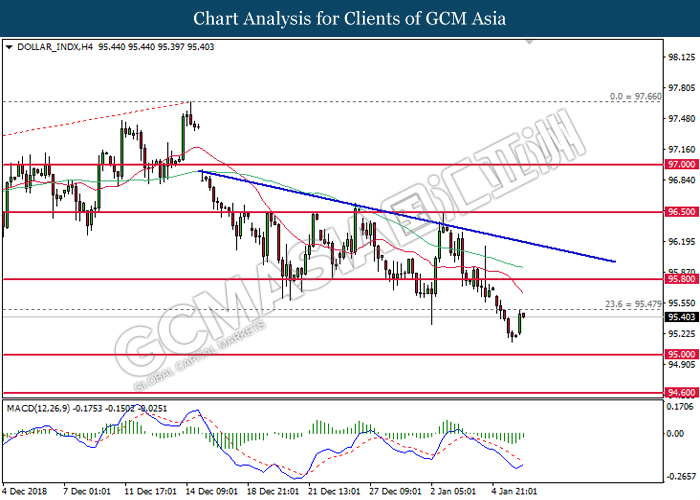

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the lower levels. MACD which illustrate diminishing downward momentum suggests the index to be traded higher in short-term as technical correction.

Resistance level: 95.50, 95.80

Support level: 95.00, 94.60

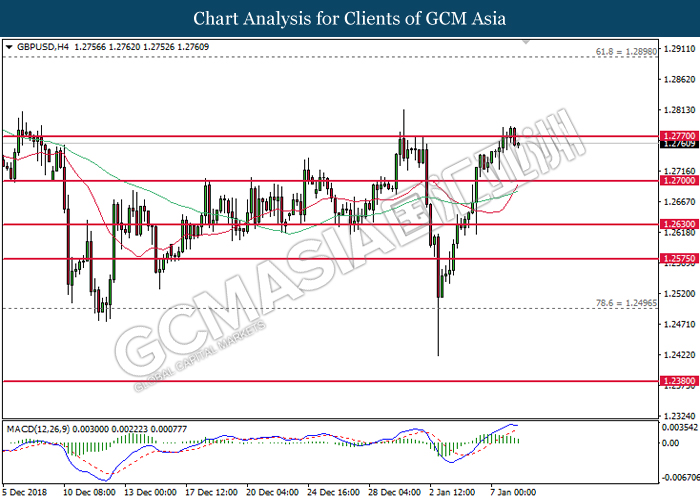

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance of 1.2770. MACD which illustrate diminished upward momentum suggests the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2770, 1.2900

Support level: 1.2700, 1.2630

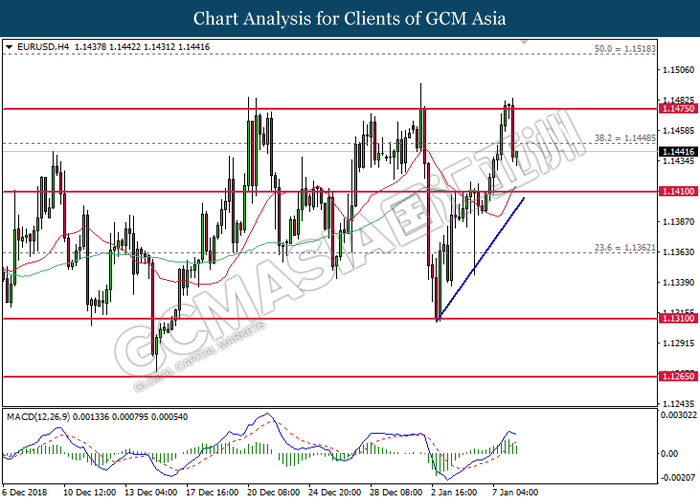

EURUSD, H4: EURUSD was traded lower following prior retracement from the strong resistance at 1.1475. MACD which illustrate diminishing upward momentum suggests the pair to extend its losses in short-term as technical correction.

Resistance level: 1.1450, 1.1475

Support level: 1.1410, 1.1360

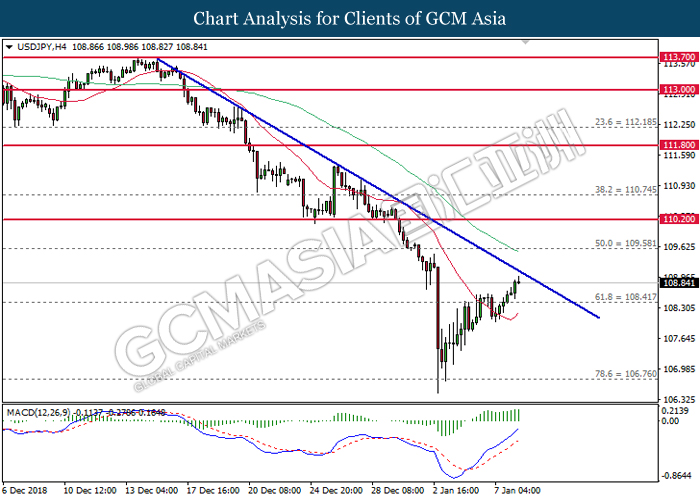

USDJPY, H4: USDJPY was traded higher following prior rebound from the lower levels. MACD which illustrate bullish signal suggests the pair to advance further upwards after a successful breakout from the downward trendline.

Resistance level: 109.60, 110.20

Support level: 108.40, 106.75

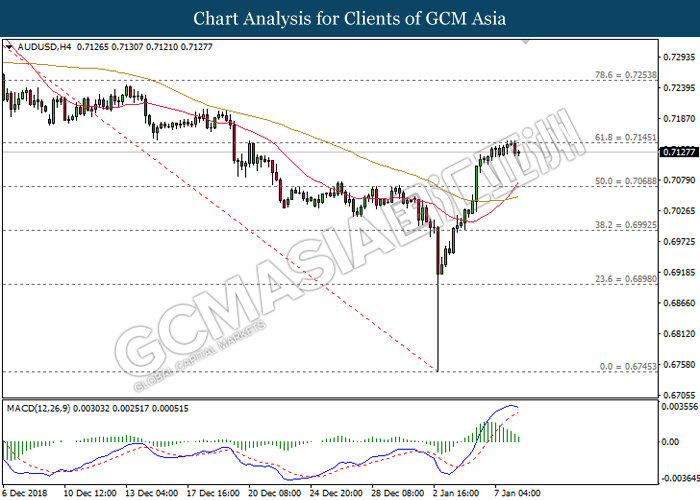

AUDUSD, H4: AUDUSD was traded lower following previous retrace from the resistance of 0.7145. MACD which illustrate diminished upward bias suggests the pair to be traded lower in short-term and experience technical correction.

Resistance level: 0.7145, 0.7255

Support level: 0.7070, 0.6990

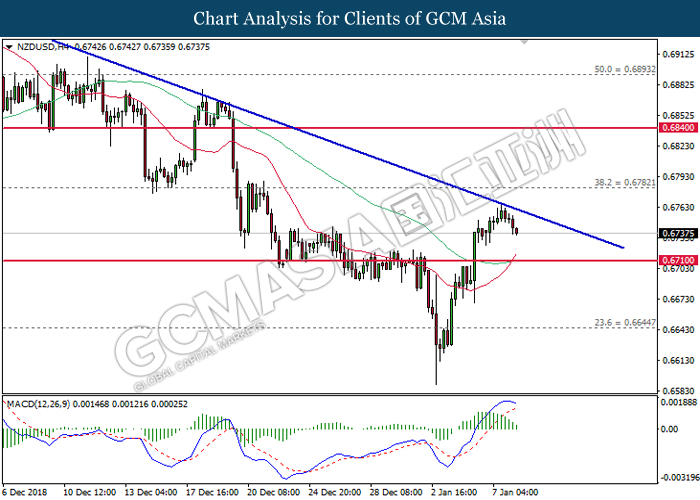

NZDUSD, H4: NZDUSD was traded lower following prior retrace from the downward trendline. MACD which illustrate diminishing upward momentum suggests the pair to experience technical correction in short-term.

Resistance level: 0.6780, 0.6840

Support level: 0.6710, 0.6645

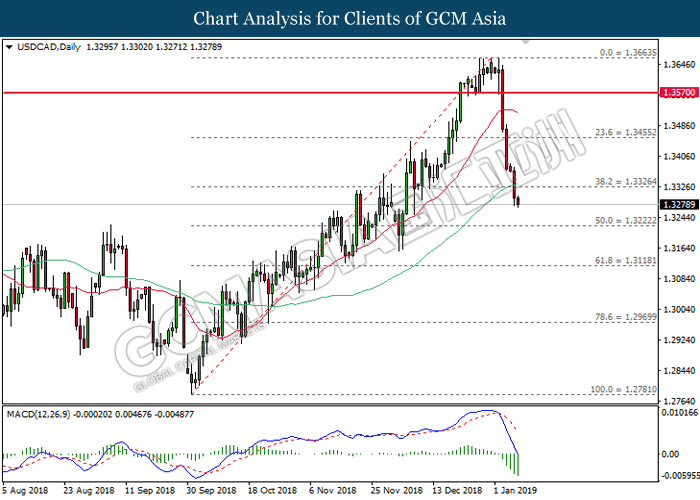

USDCAD, Daily: USDCAD extended its losses following prior closure below 1.3455. MACD which continues to illustrate bearish signal suggests the pair to extend its losses, towards the direction of 1.3220.

Resistance level: 1.3325, 1.3455

Support level: 1.3220, 1.3120

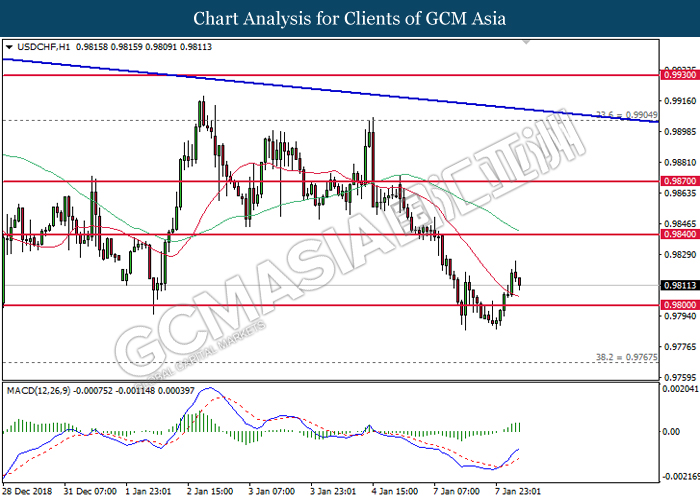

USDCHF, H1: USDCHF was traded lower following prior retracement while currently testing near the 20-MA line (red). MACD which illustrate diminished upside bias suggests the pair to continue to bearish bias in tandem with current trend.

Resistance level: 0.9840, 0.9870

Support level: 0.9800, 0.9770

CrudeOIL, H4: Crude oil price experienced some setbacks following prior retrace from 49.50. MACD which begins to form a death cross signal suggests its prices to experience technical correction in short-term.

Resistance level: 49.50, 50.25

Support level: 47.50, 45.40

GOLD_, Daily: Gold price was traded lower while currently testing near the support of 1284.35. MACD which begins to form a death cross signal suggests its prices to advance further down after successfully closing below 1284.35.

Resistance level: 1303.00, 1314.45

Support level: 1284.35, 1263.20