16 January 2019 Afternoon Session Analysis

Dollar boosted by stimulus plans.

Dollar index rose against its basket of six major rival pairs following news on increasing stimulus measures. According to reports from Guardian, China’s finance ministry have pledged to increase stimulus measures such as tax cut and boost spending to countermeasure towards unexpected fall in the China’s exports in December. Besides that, uncertainty in UK after parliamentary vote against Theresa May’s Brexit deal came in defeat also boosted the dollar as investor shy away from sterling and risk averse into dollar. Dollar index was up 0.07% to 95.66 as of writing. Meanwhile, EURUSD was down 0.08% to 1.1405 at the time of writing following German growth hits five year low. According to data, Europe’s largest economy growth slowed to 1.5% in 2018 compared to 2.2% in 2017 which is the slowest rate of growth in five years, signaling a cooling global growth which hurt market sentiment.

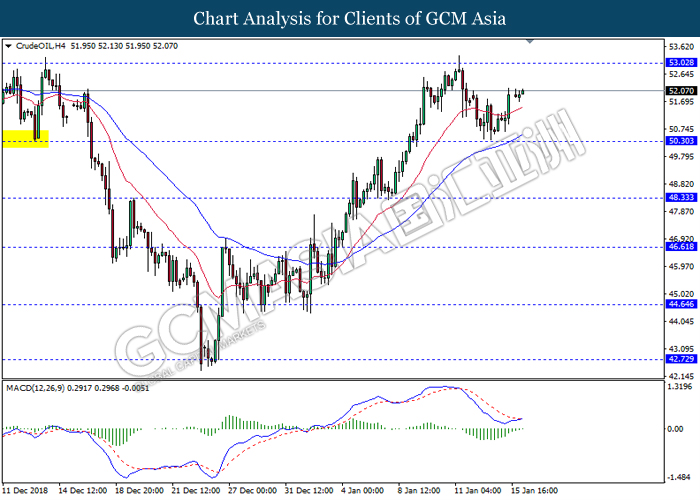

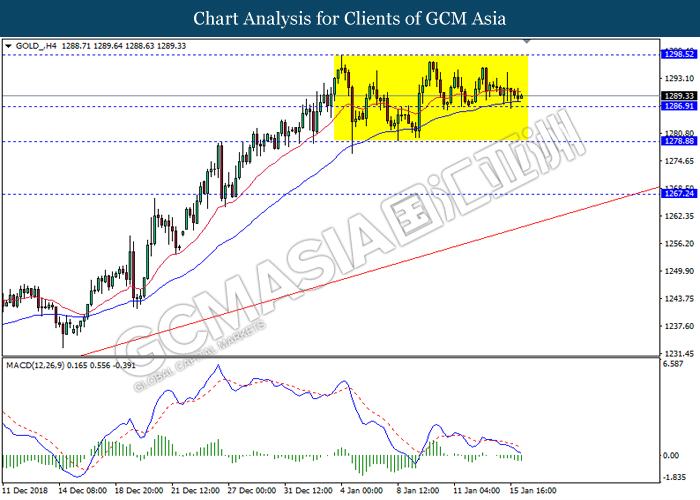

In the commodities market, crude oil price inched higher 0.12% to $52.05 per barrel as markets remains positive over OPEC-led supply cuts. Despite global growth slowdown fears, oil market remain supported by supply cuts from OPEC and its allies. Besides that, Saudi Arabia also contribute its share in supply cut where recently Saudi Arabia oil minister Khalid al-Falih also stated that its government stand ready to cut production even more deeply if needed. On the other hand, gold price remains steady and edge higher by 0.03% to 1289.41 as of writing as global growth slowdown and geopolitical risk continue to support the demand of the safe-haven asset.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:15 GBP BoE Gov Carney Speaks

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German CPI (YoY) (Dec) | 0.1% | 0.1% | – |

| 17:30 | GBP – CPI (YoY) (Dec) | 2.3% | 2.1% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Dec) | 0.2% | 0.1% | – |

| 21:30 | USD – Retail Sales (MoM) (Dec) | 0.2% | 0.2% | – |

| 23:00 | USD – Business Inventories (MoM) (Nov) | 0.6% | 0.3% | – |

| 23:30 | CrudeOIL – EIA Crude Oil Inventories | -1.680M | -1.323M | – |

Technical Analysis

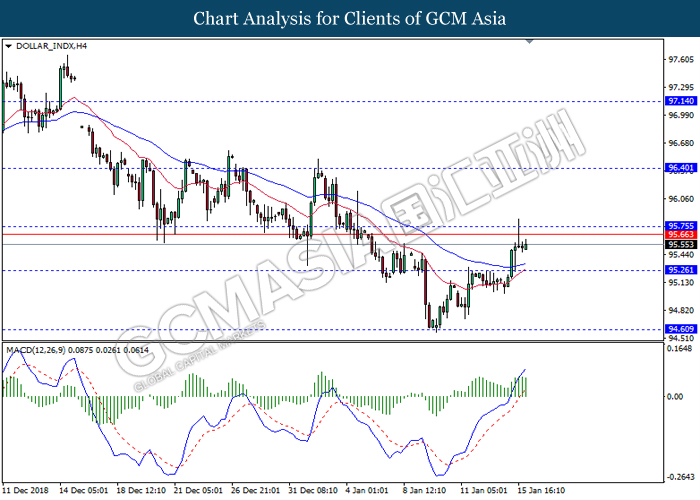

DOLLAR_INDX, H4: Dollar index was traded higher following recent breakout above the previous resistance level 95.25. However, MACD which illustrate diminishing bullish momentum suggest the pair to undergo a short term technical correction towards the support level 95.25.

Resistance level: 95.75, 96.40

Support level: 95.25, 94.60

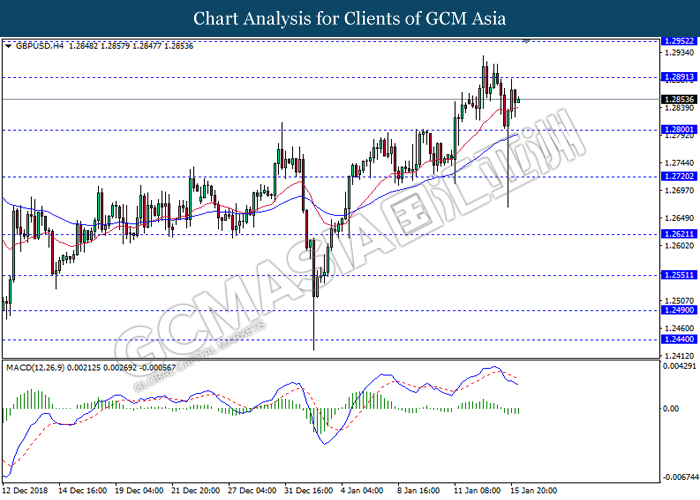

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level 1.2800. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound towards the resistance level 1.2890.

Resistance level: 1.2890, 1.2950

Support level: 1.2800, 1.2720

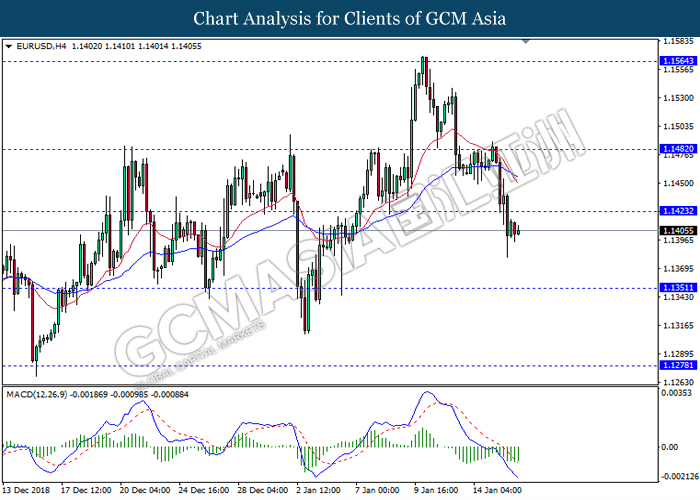

EURUSD, H4: EURUSD was traded lower following prior breakout below the support level 1.1425. MACD which illustrate continuous bearish momentum suggest the pair to extend its losses towards the support level 1.1350.

Resistance level: 1.1425, 1.1480

Support level: 1.1350, 1.1280

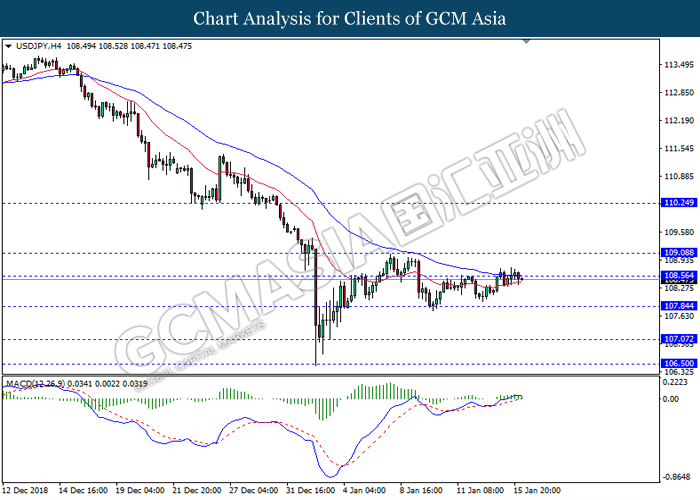

USDJPY, H4: USDJPY was traded lower following recent retracement from the resistance level 108.55. MACD which illustrate bearish bias suggest the pair to extend its retracement towards the support level 107.85

Resistance level: 108.55, 109.10

Support level: 107.85, 107.05

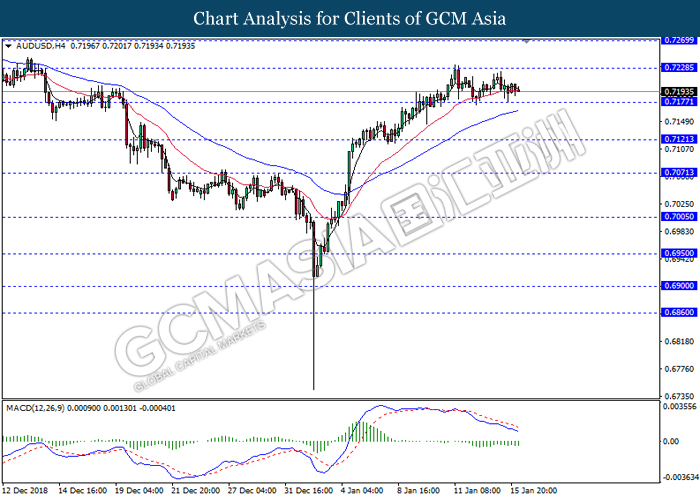

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level 0.7230. MACD which illustrate bearish momentum signal suggest the pair to extend its retracement towards the support level 0.7175.

Resistance level: 0.7730, 0.7270

Support level: 0.7175, 0.7120

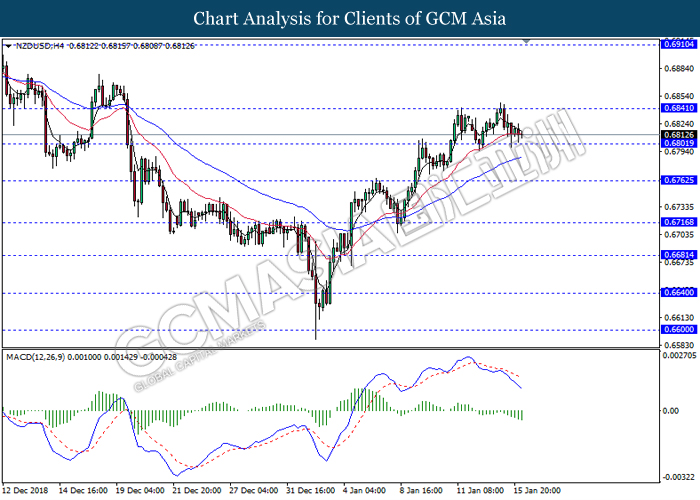

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level 0.6840. MACD which illustrate persistent bearish momentum suggest the pair to extend its retracement towards the support level 0.6800.

Resistance level: 0.6840, 0.6910

Support level: 0.6800, 0.6760

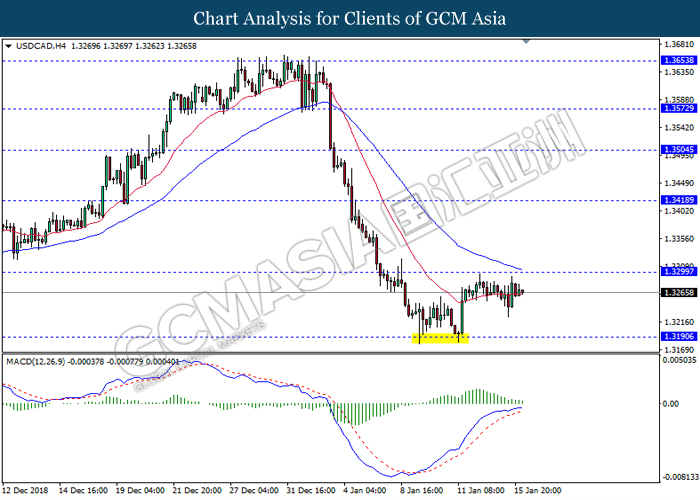

USDCAD, H4: USDCAD was traded lower following retracement from the resistance level 1.3300. MACD which illustrate bearish momentum suggest the pair to extend its retracement towards the support level 1.3190.

Resistance level: 1.3300, 1.3420

Support level: 1.3190, 1.3060

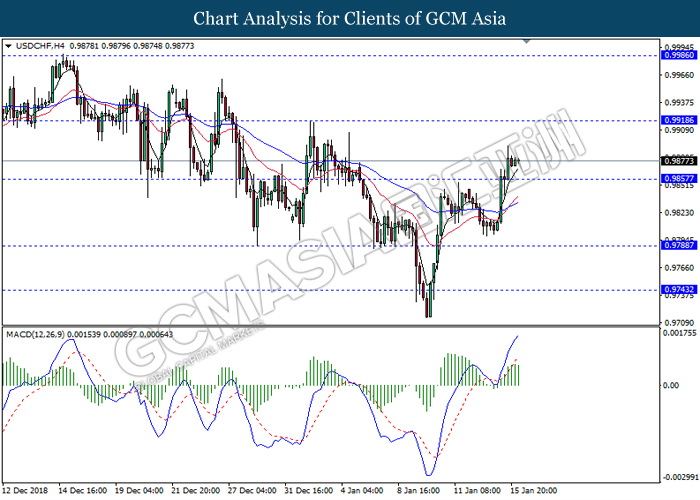

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level 0.9855. However, MACD which illustrate diminishing bullish momentum suggest the pair experience a short term technical correction towards the support level 0.9855 before resume its trend.

Resistance level: 0.9920, 0.9985

Support level: 0.9855, 0.9790

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level 50.30. MACD which display bullish momentum suggest the commodity to extend its gains towards the resistance level 53.00

Resistance level: 53.00, 55.25

Support level: 50.30, 48.30

GOLD_, H4: Gold price remain traded in a sideway channel. Due to lack of clear signal from MACD, it is suggested to wait until further signal appears such as breakout above resistance level 1298.50 or support level 1286.90 before entering the market.

Resistance level: 1298.50, 1309.00

Support level: 1286.90, 1278.90